Perks and Benefits

Meeting the needs of our valued employees.

At NVRH, we take pride in offering a comprehensive and competitive compensation package designed to meet the diverse needs of our valued employees. We understand the importance of providing benefits that cater to various lifestyles and circumstances.

All employees who work 40 hours per two-week pay period are eligible for our extensive benefits package. These benefits encompass a wide range of offerings, including medical, dental and vision coverage, short-term disability, life insurance, a 401(k) retirement plan, employee wellness benefits, and more. Benefits are effective the first of the month following 30 days of employment.

Moreover, we believe in supporting the well-being of our entire team. Therefore, every employee, regardless of hours (including per diem employees), is eligible to participate in our 401(k) retirement plan and enjoy complimentary access to a local gym.

Join us and discover the rewarding opportunities that come with being part of the NVRH family.

For a comprehensive overview of NVRH’s benefits, please refer to the Benefit Plan Overview below.

Health Insurance

Northeastern Vermont Regional Hospital offers comprehensive Medical Benefits to all full and part time benefits eligible employees. Dependents can be covered up to age 26 regardless of student status. There are 3 different medical plans to choose from allowing employees to choose the plan that best fits their needs. NVRH also offers Dr On Demand, through our affiliation with Harvard Pilgrim, Doctor on Demand gives you physician video visits from your phone, tablet or computer. NVRH offers health insurance options through Health Plans Inc. Learn more at https://hpitpa.com/

Prescription Coverage

NVRH has prescription coverage offering the flexibility of picking up your prescriptions at NVRH, another retail pharmacy or by mail order. Employees covered under our health insurance plan may purchase prescription items using payroll deduction for the applicable co-pays.

Flexible Spending Account & Health Savings Account

Flexible Spending Accounts provide you with an important tax advantage that can help you pay health care and dependent care expenses on a pre-tax basis. By anticipating your family’s health care and dependent care costs for the next year thereby setting aside money, you can lower your taxable income. FSAs are funded through a payroll deduction. The annual maximum amount you may contribute is updated annually per IRS guidelines Any unused FSA dollars up to the IR S limit may be rolled over into the following plan year. In addition we offer a Dependent Care FSA which allows employees to use pre-tax dollars toward qualified dependent care such as caring for children under the age of 13 or elder care.

Health Savings Account is 100% employee funded and contributions can be made with pre-tax payroll deductions, if elected. Employees are only eligible to participate if enrolled in the high deductible Bronze HSA Medical Plan offering. Employees will receive a Debit Card for their HSA. Employees have the option of making changes to their dollar amount of their HSA contribution at any time. Unused funds roll over year to year as long as you are enrolled in a qualifying high deductible health plan.

Vision Insurance

NVRH has two levels of vision coverage to choose from, a Low Plan and a High Plan offered through VSP. Visit https://www.vsp.com/ to find a provider.

Dental Coverage

NVHR offers 3 levels of dental coverage. Employees can choose the plan which best fits their needs. Visit https://www.deltadental.com/ to find a provider.

Life and Accidental Death & Dismemberment (AD&D) Insurance

Through Reliance Standard, NVRH offers Basic Life & AD&D insurance at no cost to benefits eligible employees. The benefit is for 2 time’s base salary to a maximum of $600,000.00. You can purchase additional insurance on yourself, spouse or children.

Short-Term Disability & Long-Term Disability

Both short-term and long-term disability are offered at no cost to benefits eligible employees.

Short Term Disability covers employees who become disabled as a result of an injury or sickness for a temporary period. It replaces a percentage of the income employees would have earned had they been able to continue working. It protects an employee’s greatest asset, the ability to earn an income.

Benefit begins on the 15th day of a disability due to injury or illness. Benefit is 75% of current base rate of pay. The maximum benefit period is 26 weeks per eligible disability. Partial benefits are available based on the percent of lost basic wages and other circumstances.

Disability income protection insurance provides a benefit for “long term” disability resulting from a covered injury or sickness. Benefits begin at the end of the elimination period and continue while you are disabled up to the maximum benefit duration.

Benefit is 66.7% of basic monthly pay up to $6,000 maximum per month. Payment of benefits begin after 180 days from the start of a qualified disability. Work with a certified rehabilitation specialist, to create a return-to-work plan that’s right for you, may include trial workdays, partial disability benefits, or rehabilitation programs to help you get back to work and back on your feet.

Accident, Critical Illness & Hospital Indemnity

Accident: When you, your spouse, or child has a covered accident, like a fall from a bicycle that requires medical attention, you can receive cash benefits to help cover the unexpected costs. You can use accident benefits to help cover related expenses like lost income, childcare, deductibles, and co-pays. Accident benefits can be used however you want, and it pays in addition to any other coverage you may already have. Benefits are paid directly to you. NVRH offers 2 plans to choose from, Standard Plan and Enhanced Plan through Voya Financial.

Critical Illness Insurance: When you, your spouse, or child is diagnosed with a covered condition, you can

receive a cash benefits to help cover the unexpected costs not covered by your health plan. Critical Insurance benefits can be used however you want, and it pays in addition to any other coverage you may already have. Benefits are paid directly to you. What’s more, all family members on your plan are eligible for a wellness screening benefit, also paid directly to you once each year per covered person.

Hospital Confinement Indemnity Insurance: provides a daily fixed indemnity benefit for eligible hospital

confinements. Employees can use the benefit as they choose – for instance, to help offset copays, coinsurance or deductibles that may be tied to a hospitalization or lost time from work.

Additional Benefits

Travel Assistance

(On Call International) Travel assistance services provide medical assistance services for employees of our Policyholders. Whenever your covered employees are on a trip in a foreign country or 100 miles or more from home, they are eligible for a wide array of medical and travel assistance services.

Pet Insurance

You may purchase voluntary pet insurance coverage on dogs, cats, avians, and exotic pets. Discounts are given for insuring more than one pet per owner. Premiums can be paid through payroll deductions. Employees opting for this coverage will be required to complete paperwork to provide directly to the insurer.

Identity Theft & Fraud Protection

ID Watchdog offers a broad range of monitoring:

- Credit Monitoring

- Non-Credit Loan Monitoring

- Payday Loan Monitoring

- Public Records & National Change of Address Monitoring

- High-Risk Transaction Monitoring

- Internet Black Market & Hacker Surveillance

- Instant-On Monitoring

- Social Network Alerts

- Registered Sex Offender Reporting & Notifications

- National Provider Identifier (NPI) Alerts

- Identity Profile Report

Wellness

Employee Assistance Program (EAP)

KGA, your Employee Assistance Program, is here for you 24/7 with confidential support as you brave the front lines. Our experienced counselors can help you manage today’s stress, in the moment, so you can return to your shift restored.

Through the Employee Assistance Program, you and the adult members of your household can access:

- Grief and trauma counseling in response to patient deaths and adverse medical incidents

- Counseling for anxiety, depression, stress, substance misuse, strain on family and personal relationships and the pressure on front line medical staff

- In the moment counseling when you have a free moment and just need to vent

- Consultations for legal* and financial concerns

- Resources for caregivers supporting children and elder/adult family members

Employee & Family Wellness Reimbursement Program

NVRH will reimburse each employees, or a member of their family who is eligible to be on the health plan, up to $200.00 /year (pre-tax). A valid receipt is required for reimbursement. Possible wellness reimbursements could include

- Aerobic fitness programs or activities

- NVRH Wellness Calendar activities (please ask for a receipt of your participation)

- Massage therapy

- Heart Healthy Contract

- Community Supported Agriculture (CSA shares)

- Race Entry Fees

- Cookbooks

- Naturopathic therapy

- Holistic therapy

- Preventive Care

- Reiki & mindfulness activities

- Fitness tracking devices

- Sports gear or protective equipment

- Sneakers or boots (running, walking, hiking, etc.)

- Health & wellbeing workshops

- Weight Watchers

RecFit located in St. Johnsbury

NVRH employees free access to RecFit. This benefit does not include family members. NVRH photo ID is required and some classes are included!

NVRH Cardiac Rehab Equipment

Free employee use of the aerobic equipment in Cardiac Rehab on the third floor during non-patient hours. Click here to visit NVRH Cardiac Rehab https://nvrh.org/cardiac-rehabilitation/

Retirement

NVRH 401(k) Retirement Plan

All regular full-time, part-time and per diem employees are eligible on the first of the month after 30 days of service with NVRH. Contributions: All employees receive 3% contribution from NVRH to their 401k plan. If an employee makes at least a 2% pre-tax contribution to their 401k, NVRH matches an additional 1.5%. Total contribution is 6.5%.

Roth (post-tax) deferrals are allowed. Rollovers are allowed from 401k to 403b and vice-versa.

529 College Savings Plan

With college costs rising faster than inflation, many students need assistance paying for their higher education. To help you save for this important goal, your employer, working alongside a financial advisor, is offering you a CollegeAmerica 529 plan as part of your benefits package. This benefit has the convenience of payroll deduction and employees can cancel at any time.

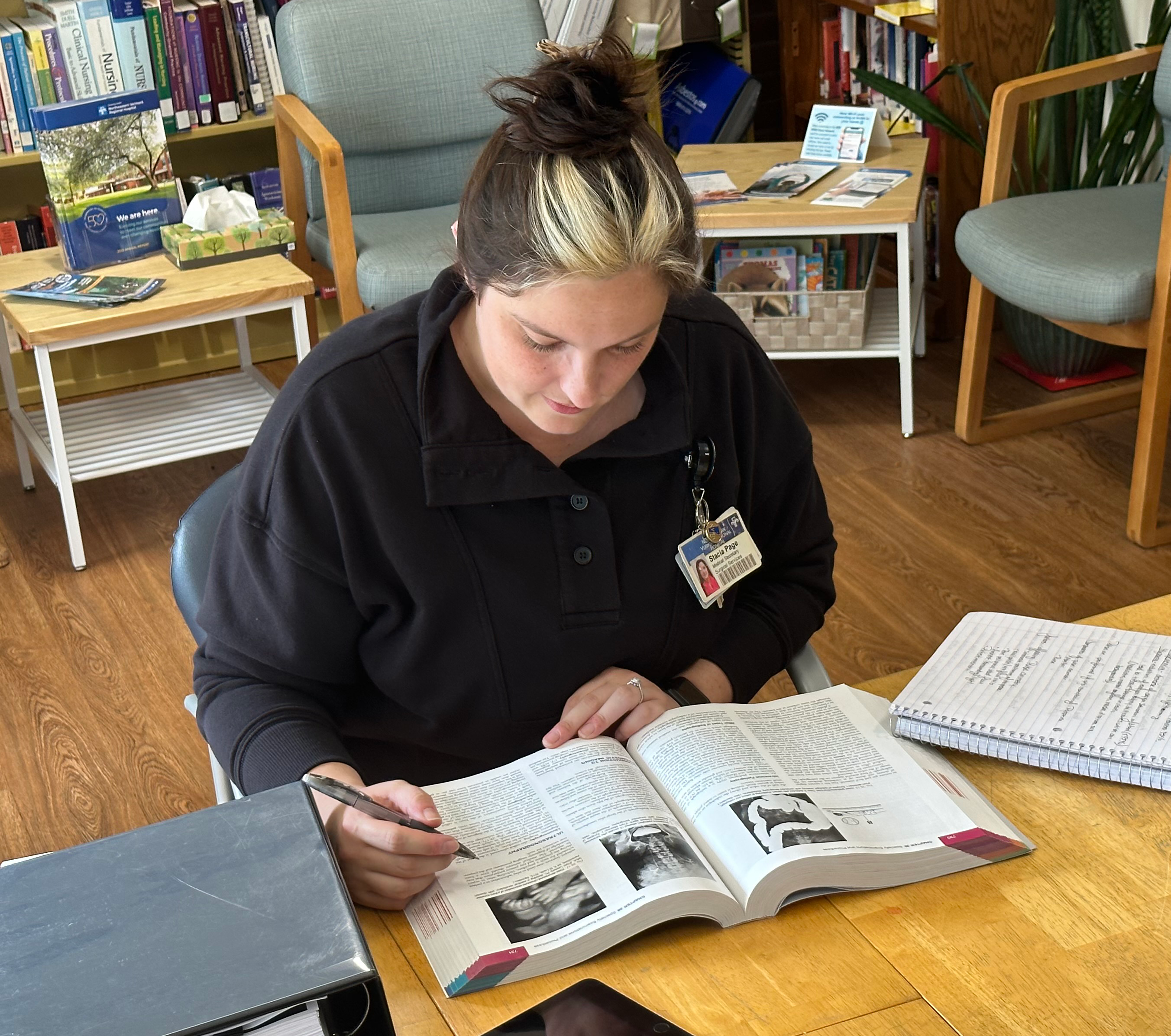

Educational/Professional Development

Tuition Assistance

Regular full and part-time employees, after 90 days of employment, are eligible to receive reimbursement for tuition up to $4,000 per calendar year.

Student Loan Refinancing

The NVRH tuition assistance program is designed to help NVRH employees pay back student loan debt and improve their financial wellbeing by a free consultation with GradFin to reduce student loan debt or funding to go back to school.

Public Service Loan Forgiveness

GradFin’s Public Service Loan Forgiveness (PSLF) Membership Program is designed to help borrowers benefit from tax-free student loan forgiveness. As a not-for-profit organization employees of NVRH may be eligible for the PSLF Program.

Student Loan Repayment Program

Congratulations, you work for a company who cares about your financial future! Through this program, managed by BenefitEd, NVRH would like to fund an additional monthly payment toward the repayment of your student loan(s). Full-time and part-time benefits eligible employees are able to take advantage of up to $150.00/month paid directly to your loan servicer. This payment, coupled with your regular monthly payment, will help you pay down debt faster.

Employee Perks

Northeastern Vermont Regional Hospital offers:

- Payroll direct deposits

- Paylocity Self-Service Portal

- Cafeteria/Gift Shop/Pharmacy- payroll deductions

- NVRH Auxiliary Shows- Uniform Professionals, Asian Silks & Silvers, Bag Ali,

- Collective Goods, Love My Clogs- and more!- payroll deductions

- Hospital Bill Payment Plan

- Interest Free Finance Program for computer related hardware ($1,000 max)

- CSA Locally Grown Produce Delivery

- Community Garden

- AT&T, Verizon Discounts

- Joy Committee Events and Challenges

Working Bridges

Working Bridges is a collaborative convened by the United Way that brings together public and private sectors to focus on business solutions – job retention, productivity, advancement – by support low-to-moderate wage earners and using the workplace as a platform for social services.

Tobacco Cessation

We continue to encourage any employee who uses tobacco to take advantage of our free-tobacco-cessation benefits, including: 1) individual counseling; 2) 10 weeks of free nicotine replacement products; 3) tobacco cessation support services for employees and dependents.

Compensation

Differentials

Employees who work on the evening, night, or week-end shift are eligible for this hourly pay supplement for eligible hours when working the appropriate shift and when percentage of worked hours on shift criteria is met. The differentials are $3.00/hour Evenings; $5.00/hour Nights; $3.00/hour Weekends.

Overtime

Hourly employees, when working in excess of 40 hours per week, are eligible to receive time and one-half your average base hourly rate.

Direct Deposit

Employees with accounts may opt to have their paycheck, or a portion of their paycheck, automatically deposited to their local bank. Electronic paystubs are also an available option, eliminating usage of a paper paystubs.

Hospital Bill Payment Plan

For employees incurring NVRH hospital bills, a consistent, interest free payment plan may be arranged through the Patients Accounts Department. An additional option of payroll deduction is also available.

Time Off From Work

Paid Time Off

Regular full and part time employees are eligible to accrue paid time off (PTO) immediately. PTO may be used as per policy on the first of the month after thirty days of employment. You may accrue 25, 30, or 35 days annually depending on length of service, hours worked, and employment status.

Earned Time Cash in

Employees, when eligible to receive PTO, may cash in a portion of PTO on selected dates. During the period between December 1st and December 31st, employees will have the opportunity to pre-elect to cash in at 100%. If not pre-elected, and if eligibly requirements are met, the cash in will be at 75%.

Leaves of Absence

Employees, on the first of the month after thirty days of employment may receive an approved absence from work without loss of seniority. NVRH also offers Paid Parental Leave. In addition, as required by state and federal law, a “Family Leave” of up to twelve weeks may also be granted.

Bereavement

Full and part-time employees with at least three months of continuous service are allowed up to five days leave with pay following the day of death of a spouse or partner, or the employees’ child; and three days of leave with pay following the death of another immediate family member, including parents, brothers and sisters, brother and sister-in-law, mother and father-in-law, children and any other relative who had been residing in the same household at the time of their death.

Other Benefits

Cafeteria

Cafeteria benefits are extended immediately to all employees, which includes payroll deducted meals, a free meal on their birthday, and free meals on Christmas and Thanksgiving.

Employee Gift Fund

Employees wishing to join may become members of the Employee Gift Fund immediately and will receive gifts on indicated occasions.

Free Parking

The hospital maintains a parking lot with ample space for employees to park their cars within close proximity to the hospital.

Gift Shop

The Cherry Wheel Gift Shop is supported by our hospital volunteers and is open for employee and visitor shopping convenience.

Computer Hardware

The hospital will finance up to $1,000, interest free, for the purchase of computer hardware. Repayment is made using the payroll deduction program.

Medicare Navigation

Medicare is very complex and it is important than you have advocate who can provide you the proper Medicare education and guidance. NVRH partnered with SmartConnect, an exclusive, no cost program designed to connect Medicare-eligible working adults to the world of Medicare benefits.

Looking to access our Health Plans, Inc. Machine Readable Files (MRF)? Click here.